Typical assignments & projects:

Identify specific, high revenue growth and profit opportunities.

Identify and profile competitors or targets for acquisitions or partnerships.

Review external environment to identify significant events, major disruptions and inflection points affecting end-user markets, customer industries, and competitors.

Examine in detail from private commercial databases the sales, purchases and imports of commercial and industrial products in North America.

Analyze and forecast industrial and commercial markets.

Provide information and data beyond common knowledge and misleading assumptions.

Assist in formulating corporate strategy.

Benchmark companies or functions.

Prepare strategic profiles of business segments.

Assess business ventures and opportunities.

Most projects have a North American or international focus.

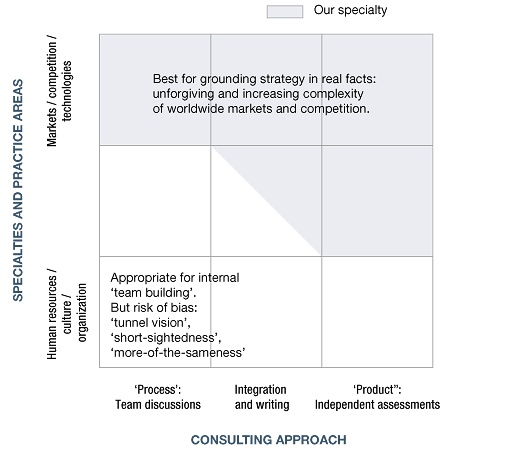

Positioning of our strategy consulting services

Our competitive edge

In meeting your needs and objectives, we combine:

A sound approach where profits, quality and sustainability always matter.

Solid training in business (MBA, Harvard Business School), economics (M.Sc., Laval University), and electrical engineering (B.S.E.E., Laval University).

More than 20 years of consulting experience

A rich variety of data sources: commercial databases, trade magazines and business papers from around the world; direct surveys; your own data; …

Fluency in English and French; reading ability in German, Spanish and Italian.

Access to native speakers for many other languages in Europe and Asia.

Superior analytical skills about markets, technology, competition, finances, geographies.

Presentations of complex subjects aimed at intelligent readers who are not specialists.

We devote our best efforts to your needs and objectives, and we promise you exclusivity in your line of business:

No pre-packaged answers, unlike suppliers of multi-client studies.

No mental restrictions, unlike ultra-specialists with potential conflicts about other clients.

No training of junior consultants on your projects, unlike larger consulting firms.

No generic platitudes, unlike ‘process’ consultants that do not take time to understand your needs, products, clients and competitors.

Industry Specialties – Electricity and Energy

Typical experience in electricity & energy

North American market forecast for large electric power transformers: inflection points for key segments.

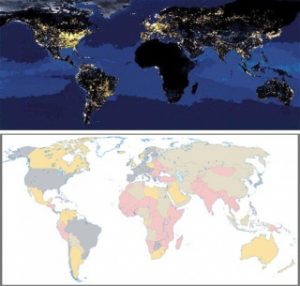

Identification of world regions where high-performance metal fittings are required in geothermal plants: near volcanoes and in earthquake zones at edges of continental plates.

Identification of world regions where high-performance metal fittings are required in geothermal plants: near volcanoes and in earthquake zones at edges of continental plates.

Strategic overview of world energy consumption, production and reserves by continent and country (oil, gas, coal, hydro, nuclear, others).

Technical Products

Typical experience in technical products

Industry profile for new product line: markets, customers, competitors, technologies (together with client specialists).

Industry profile for new product line: markets, customers, competitors, technologies (together with client specialists).

Sales growth potential for key components in industrial anti-pollution equipment: review of product lines, client survey, key international markets, key competitors.

Strategy and international partnership for hydrogen storage materials: market definition and profiling; partners identification, approaches, and discussions; Joint Venture between 4 world-class parties from 4 countries and 4 cultures.

Strategy and international partnership for hydrogen storage materials: market definition and profiling; partners identification, approaches, and discussions; Joint Venture between 4 world-class parties from 4 countries and 4 cultures.

Key issues:

How do we sell what to who, to be used or installed where, why and when?

What features, functions and benefits do users want and need?

How are end-user markets evolving?

How can we survive and prosper in global markets and competition?

Telecommunications

Typical experience in telecommunications

Specialty transmission equipment:

market drivers, competition and perspectives in key countries around the world.

Acquisition opportunities around the world.

New telecom technologies: assessment of potential for equipment suppliers, competitors, or service providers.

Important issues:

Continuing fast growth in many market segments.

Continually evolving technologies.

Overcapacity for many equipment suppliers and service providers.

Decreasing unit costs.

Many bankruptcies caused by irrational exuberance of last decade.

Financial Groups

Typical experience with financial groups

Venture capital:

Identify and profile specialized partners in North America and Europe

Private equity:

Profile North American and European funds active in selected industries, as competitors for acquisitions or candidates for divestitures.

Others:

Combine client financial skills with our specialized expertise in markets, competition and technology.

Assess investment opportunities using a demand-driven approach for better results.

Protect and develop client investments through periodical reviews.

Benchmark selected internal activities of financial group